Fair, intuitive and transparent pricing

How we work out your health insurance renewal premium

A - your Age

B - the Base rate increase

C - an adjustment for the Claims you have made and your Vitality status. This is the part of your renewal premium that you can control.

The increase in your renewal premium will be the sum of these three items: A+B+C.

As it is more likely you will need to claim as you get older, your premium will rise each year to take account of this.

How the Base rate increase affects your premium

The base rate increase takes into account the change in what hospitals and other providers charge for their services, including the cost of advances in medical technology and drugs. Where you live and your level of cover can also affect the base rate increase.

How Claims affect your premium

We look at the amount paid out in claims over the preceding plan year for everyone on your plan. If you only make a small claim, or no claims at all, you’ll receive a lower increase.

How Vitality status affects your premium

Regardless of whether you make a claim, increasing your Vitality status can reduce the increase to your premium.

With us, you earn Vitality points for doing healthy things, like having a yearly health check and tracking your daily activity – walking, running, cycling, swimming or going to the gym.

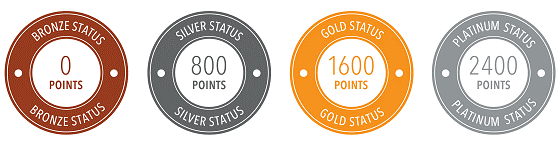

The more points you earn, the higher your Vitality status, the bigger the rewards and the lower your premium can be. Here’s how many points you need for each status when there is one adult on the plan:

Frequently asked questions

How much will my premium rise due to age?

How much will the premium rise due to the base rate increase?

The base rate increase tends to be higher than overall inflation, as measured by the Consumer Price Index (CPI). This is due to advances in medical treatment that mean more conditions can be treated than ever before. In the last few years, the base rate increase has typically been between 6% and 9%. However, it could be higher or lower in the future, and can vary depending on where you live and your level of cover.

How are your renewal premiums unique?

Will I keep my no-claims discount if I switch to Vitality from another insurer?

You may still get an equivalent discount when you join us. You’ll need to send us your renewal quote and certificate of insurance. Then we’ll look at how many relevant claims you’ve made, and how long you’ve been insured.

When will you calculate my renewal premium?

Do all claims affect renewal premiums or are some excluded?

Claims paid under the following plan benefits won’t affect your renewal premium:

- Primary Care Benefit, including consultations with a Vitality GP or private GP on our provider panel

- Prescription charges or minor diagnostic tests ordered by a Vitality GP or private GP on our provider panel

- NHS Hospital Cash Benefit

- Childbirth Cash Benefit

- Dental Cover (if you have this benefit)

- Worldwide Travel Cover (if you have this benefit)

Or ask for a call back and we’ll get in touch at a time to suit you.

Lines are open:

Monday to Thursday 9am-6pm, Friday 9am-5pm, Saturday 10am-2pm

Sunday and bank holidays: Closed